There’s an old-school way of looking at market potential: Total Addressable Market (TAM). But it’s big, it’s shiny, and it looks awesome in an investor deck.

But here’s the truth, TAM is also a trap.

If you say your market is “all SMEs in Australia,” you technically may not be wrong. But you’ve also just lumped George’s Fish & Chip Shop in with a national real estate franchise. And shock: these businesses have nothing in common when it comes to problems to solve, jobs to done, or how they make decisions.

So let’s get honest about how we define the market we’re really going after. The cost of getting this wrong is real. Startups can easily waste millions in time and marketing dollars chasing the wrong customers, with the wrong messaging, and building for a market that was never the right fit to begin with.

From TAM to…TRM…WTF?

The smarter, more strategic approach is forgetting TAM, and thinking about Total Relevant Market (TRM).

Total Addressable Market (TAM) is everyone you could sell to.

TRM is who you should sell to. The buyers in your sweet spot, and getting the most value and ROI from what you offer right now.

And when you focus on the right market, good things happen (Hubspot nailed this growing from $15 million to $270 million in 4 years and surpassing $2 billion in revenue with over 100% net revenue retention…yikes…those are some big numbers):

- You connect with the right pain points and problems

- Your messaging finally resonates

- You stop wasting money on people who were never going to buy anyway

- You start talking to more qualified leads

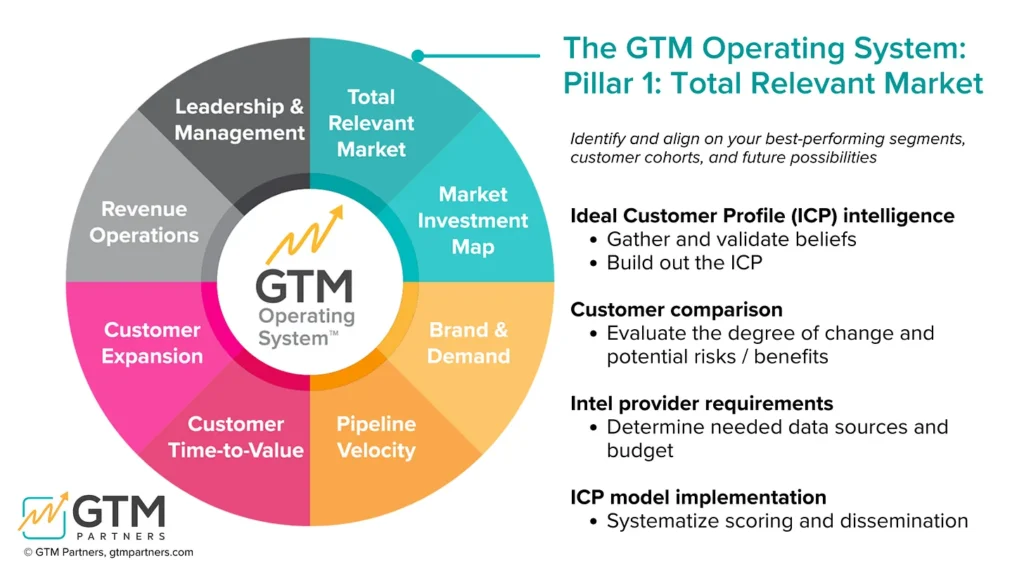

Image courtesy of GTM Partners

Please Explain

TAM is the total universe of potential customers. It’s the top-down number (ie, all SMEs).

TRM is a more considered slice (ie, SME’s on the east cost, with less than 20 employees, and have been in business for more than 5 years, turning over under $5m).

And what about ICP? This is your Ideal Customer Profile, your bullseye, the ones most likely to buy, grow, and stick around. In fact, you could even have multiple ICPs within one TRM.

You could have a $10B TAM, a $1B TRM, and a $100M ICP. And that’s a good thing. The tighter your focus, the clearer your GTM strategy becomes.

Sue Foley

Niche Down To Grow Up

According to McKinsey, half of startups convert fewer than 10% of their ideal potential customers. And when that happens, their chance of surviving the next five years drops by 50%. Eeek!!!

Translation? If you don’t know who your real market is, your GTM strategy is probably broken (sorry).

The more specific you get, the easier it is to:

- Craft messaging that resonates

- Build a product roadmap that makes sense

- Align sales, marketing and CS

- Optimise conversion

- Know where to spend your $$$

Niching Down Isn’t Playing Small, It’s Playing Smart

Yes, it can feel risky to “cut out” large chunks of your potential market. But if you try to talk to everyone, you end up connecting with no one. That’s how you waste budget, frustrate teams, and lose momentum.

When you know your TRM, you stop guessing. You start focusing. And that’s where growth really begins.

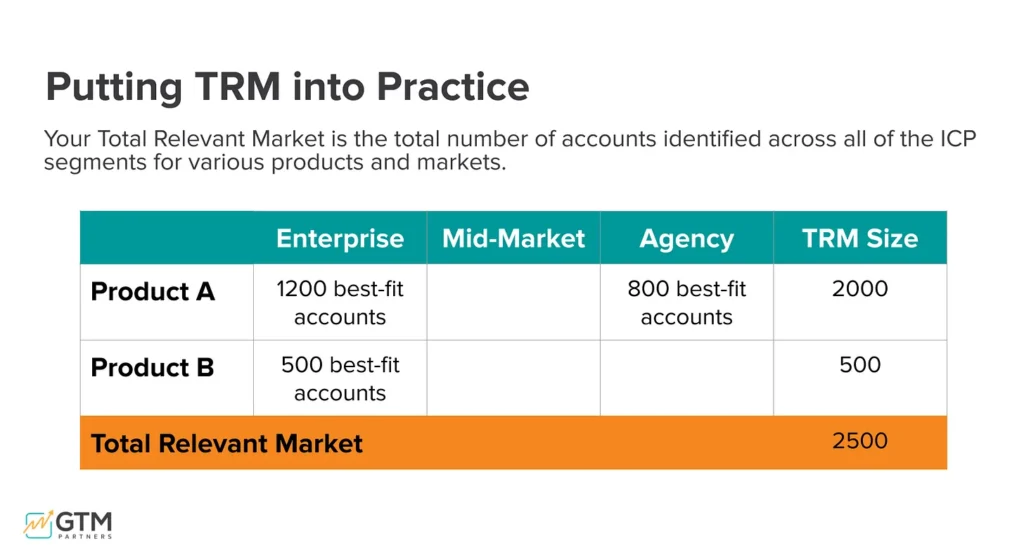

Image courtesy of GTM Partners

Defining your TRM isn’t easy. It’s hard and often uncomfortable. But it’s the foundation for building a GTM system that actually works. With the right TRM, you know where to double down on product enhancements, how to speak directly to your prospects, get customers to value quickly, grow accounts, and align your teams around a shared vision of success.

At MarketCraft GTM, I help SaaS and tech businesses define their TRM and build GTM strategies that connect. If your team is still working off a generic TAM and you’re struggling to get traction, I can help you fix that.